Passive Income Streams to Replace a Full-Time Job: A Comprehensive Strategy Guide

In today's dynamic economic landscape, traditional employment is no longer the only path to financial stability. More individuals are discovering the power of creating multiple passive income streams that can potentially replace a full-time job. This comprehensive strategy guide will explore proven methods to build sustainable passive income that offers financial freedom and flexibility.

Understanding Passive Income Potential

Passive income represents earnings generated with minimal ongoing effort. Unlike traditional employment, these income streams continue to produce revenue even when you're not actively working. The key is developing strategic investments and systems that generate consistent returns.

Digital Asset Creation Strategies

Digital products offer remarkable passive income opportunities with low startup costs:

- Online courses teaching specialized skills

- E-books addressing specific market needs

- Digital templates and downloadable resources

- Stock photography and graphic design assets

By creating high-quality digital products once, you can sell them repeatedly through platforms like Udemy, Teachable, and Amazon Kindle Direct Publishing.

Investment-Based Passive Income Channels

Intelligent investment strategies can transform your financial landscape:

Dividend-Generating Investments

Strategic stock market investments focusing on dividend-paying companies provide consistent passive income. Consider:

• Blue-chip stocks with reliable dividend histories

• Exchange-traded funds (ETFs) specializing in dividend investments

• Real Estate Investment Trusts (REITs)

Rental Property Income

Real estate remains a powerful passive income generator. Options include:

- Residential rental properties

- Commercial property investments

- Vacation rental management

- Real estate crowdfunding platforms

Modern technology has simplified property management through platforms like Airbnb and professional property management services.

Online Business Models

The internet offers unprecedented passive income opportunities:

Affiliate Marketing

Promote products from established brands and earn commissions without managing inventory. Successful affiliate marketers leverage:

• Niche websites

• YouTube channels

• Social media platforms

• Targeted email marketing

Monetized Content Creation

Create engaging content that generates revenue through:

- YouTube advertising revenue

- Blog monetization with display ads

- Podcast sponsorships

- Sponsored social media content

Passive Income Technical Requirements

Developing sustainable passive income streams requires:

• Initial time investment

• Continuous learning

• Technical skill development

• Strategic planning

• Patience and persistence

Risk Management Strategies

Diversification is crucial when building passive income. Never rely on a single income stream. Spread investments across multiple channels to minimize potential financial risks.

Scaling Your Passive Income

Successful passive income generation involves:

• Reinvesting initial earnings

• Continuous skill enhancement

• Adapting to market trends

• Exploring emerging opportunities

Financial Technology Tools

Leverage modern financial technologies to streamline passive income management:

- Automated investment platforms

- Passive income tracking applications

- Tax optimization software

- Portfolio management tools

Transforming passive income from a supplemental strategy to a full-time revenue replacement requires dedication, strategic planning, and continuous adaptation. By implementing diverse income streams and maintaining a growth mindset, you can create a robust financial ecosystem that provides long-term stability and freedom.

Diversifying Your Income: Top Digital and Offline Passive Revenue Opportunities

In today's dynamic economic landscape, building multiple income streams has become more than just a financial strategy—it's a pathway to financial freedom and security. Modern professionals are increasingly looking beyond traditional employment models, seeking innovative ways to generate revenue that doesn't require constant active involvement.

Digital Investment Platforms

Online investment platforms have revolutionized passive income generation. Platforms like Robinhood, Acorns, and Betterment allow individuals to create diversified investment portfolios with minimal initial capital. By leveraging algorithmic trading and robo-advisory services, you can potentially earn returns without daily management.

Key Digital Investment Strategies

- Exchange-traded funds (ETFs)

- Dividend-yielding stocks

- Cryptocurrency staking

- Peer-to-peer lending

Digital Content Monetization

Content creators can transform their skills into sustainable revenue channels. YouTube channels, podcasts, and online courses represent powerful opportunities for generating passive income. By creating high-quality, evergreen content, creators can earn through:

• Ad revenue

• Affiliate marketing

• Sponsorship deals

• Digital product sales

Real Estate Investment Opportunities

Real estate remains a cornerstone of passive income strategies. Modern investors can access property investments through multiple channels:

- Real Estate Investment Trusts (REITs)

- Crowdfunding platforms

- Rental property management apps

- Short-term vacation rental platforms

These options enable investors to participate in real estate markets with lower capital requirements and reduced hands-on management.

Affiliate Marketing Ecosystems

Affiliate marketing offers a scalable passive income model. By promoting products through blogs, social media, and dedicated websites, individuals can earn commissions without maintaining physical inventory. Amazon Associates, ShareASale, and ClickBank provide extensive product networks for marketers.

Automated Online Business Models

Dropshipping and print-on-demand businesses represent low-overhead passive income streams. These models allow entrepreneurs to:

• Create online stores without inventory

• Automate order fulfillment

• Generate revenue through targeted marketing

• Scale operations with minimal personal intervention

Intellectual Property Income

Creative professionals can monetize intellectual assets through:

• eBook publishing

• Stock photography

• Music licensing

• Software development

• Patent royalties

Each of these channels provides potential for recurring revenue without continuous active work.

Passive Income Technology Tools

Modern technology has simplified passive income generation. Apps and platforms like:

• Rakuten

• Swagbucks

• Honeygain

• Cashback credit cards

Enable users to earn money through everyday activities and online interactions.

Financial Considerations

While passive income streams offer exciting opportunities, they require:

• Initial time investment

• Continuous learning

• Risk management

• Diversification

• Patience for long-term growth

Successful passive income strategies demand strategic planning and consistent execution. By combining multiple revenue streams and leveraging digital platforms, individuals can create robust financial ecosystems that provide stability and potential wealth accumulation.

The journey toward financial independence begins with understanding available opportunities and taking calculated risks. Each passive income stream represents a potential building block in your broader financial architecture.

Embracing a multi-dimensional approach to income generation empowers individuals to break free from traditional employment constraints, offering greater financial flexibility and personal autonomy.

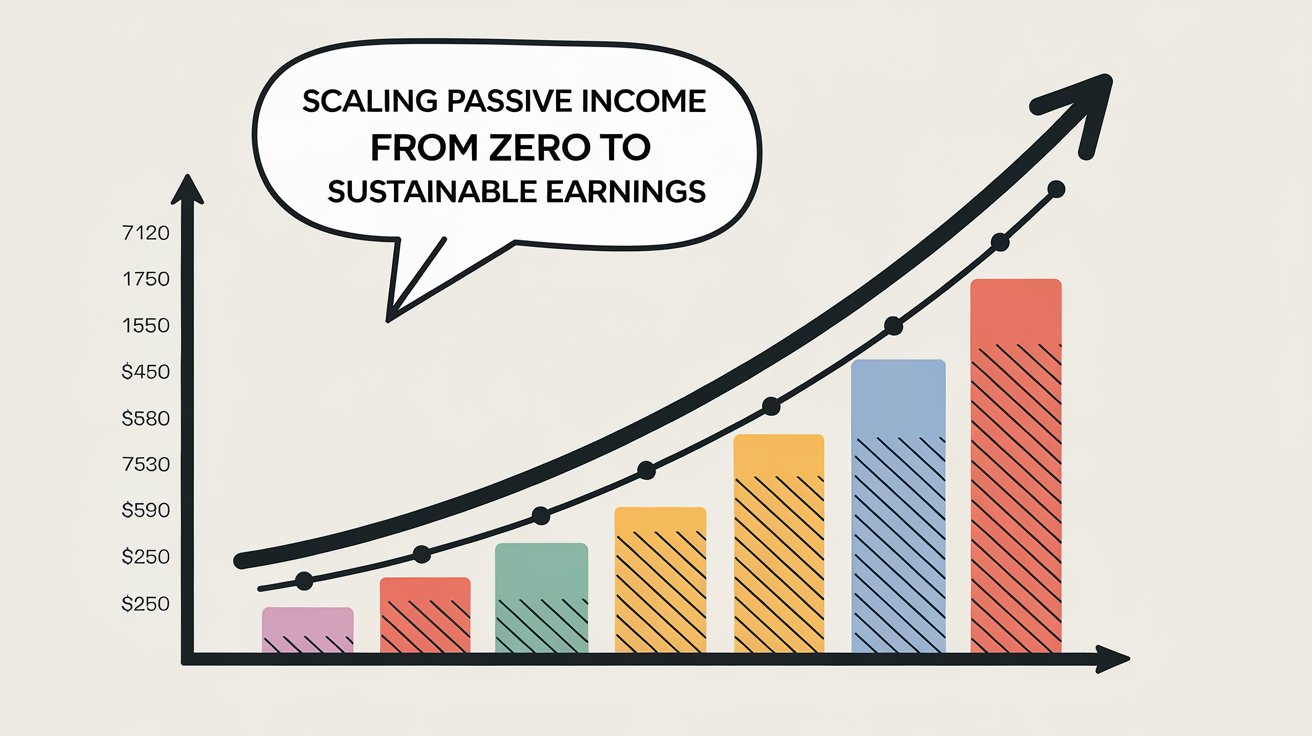

Building Financial Freedom: Scaling Passive Income from Zero to Sustainable Earnings

In today's dynamic financial landscape, transforming your income potential requires strategic thinking and innovative approaches. Many individuals dream of breaking free from traditional employment constraints, seeking financial independence through smart passive income generation.

Understanding Passive Income Fundamentals

Passive income represents earnings generated with minimal ongoing effort. Unlike traditional work models, these revenue streams continue producing money even when you're not actively working. The key is developing systems that generate consistent returns with limited daily management.

Digital Asset Development Strategies

- Create online courses targeting specific skill niches

- Develop digital products like e-books and templates

- Build scalable software solutions

- Design monetizable digital content

Investment-Driven Passive Revenue Models

Smart financial investments can create sustainable income channels. Consider diversifying across multiple platforms to minimize risk and maximize potential returns. Dividend-paying stocks, real estate investment trusts (REITs), and index funds offer relatively stable passive earnings opportunities.

Strategic Investment Approaches

Successful passive income investors understand the importance of:

- Consistent portfolio rebalancing

- Risk management

- Long-term perspective

- Continuous financial education

Content Creation and Monetization

Modern digital platforms provide unprecedented opportunities for content creators. YouTube channels, podcasts, blogs, and social media accounts can generate substantial passive revenue through advertising, sponsorships, and affiliate marketing. The key is producing high-quality, engaging content that attracts and retains audience attention.

Affiliate Marketing Potential

Affiliate marketing allows individuals to earn commissions by promoting products or services. By developing authentic recommendations and targeting specific audience segments, creators can build lucrative income streams with minimal ongoing effort.

Real Estate Passive Income Opportunities

Real estate remains a powerful passive income generator. Options range from traditional rental properties to modern alternatives like crowdfunded real estate platforms. Investors can now participate in property investments with significantly lower capital requirements compared to traditional approaches.

Innovative Real Estate Investment Channels

- Residential rental properties

- Commercial real estate investments

- Real estate crowdfunding platforms

- Short-term vacation rental management

Technology-Driven Passive Income Streams

Emerging technologies continue expanding passive income possibilities. Cryptocurrency staking, peer-to-peer lending platforms, and automated trading algorithms offer innovative methods for generating consistent returns.

Technical Skill Considerations

While technology-driven income streams promise attractive returns, they require careful research and understanding. Potential investors should invest time in learning platform mechanics, risk management strategies, and market dynamics.

Financial Planning and Risk Management

Successful passive income generation demands comprehensive financial planning. Develop a diversified approach, maintain emergency funds, and continuously educate yourself about emerging opportunities and potential challenges.

Remember that building sustainable passive income is a journey requiring patience, strategic thinking, and consistent effort. Start small, learn continuously, and gradually expand your income streams. With dedication and smart planning, financial freedom becomes an achievable reality.

Risk Management and Investment Techniques for Long-Term Passive Income Success

Building sustainable passive income requires strategic planning and intelligent investment approaches. Successful investors understand that creating reliable revenue streams goes beyond simple financial transactions. The key lies in developing a comprehensive strategy that balances risk management with consistent growth potential.

Strategic Asset Allocation Techniques

Diversification remains the cornerstone of robust passive income generation. Smart investors spread their investments across multiple channels to minimize potential risks and maximize returns. Consider implementing these targeted allocation strategies:

- Real estate investment trusts (REITs)

- Dividend-paying stocks

- Bond index funds

- Peer-to-peer lending platforms

- High-yield savings accounts

Understanding Risk Tolerance

Your personal risk tolerance plays a critical role in designing an effective passive income strategy. Younger investors can typically afford more aggressive investment approaches, while those closer to retirement might prioritize stability and consistent returns.

Investment Portfolio Balancing

Professional investors recommend maintaining a dynamic portfolio that adapts to changing market conditions. This means regularly reassessing your investment mix and making calculated adjustments based on economic indicators and personal financial goals.

Digital Passive Income Opportunities

Technology has revolutionized passive income generation, offering innovative ways to create sustainable revenue streams. Online platforms provide numerous opportunities for generating income with minimal ongoing effort:

- Creating digital products like online courses

- Developing mobile applications

- Monetizing YouTube channels

- Affiliate marketing strategies

- Writing and publishing e-books

Income Stream Optimization

Successful passive income generation requires continuous learning and adaptation. Investors must stay informed about emerging trends, technological advancements, and market dynamics that could impact their revenue streams.

Advanced Risk Mitigation Strategies

Implementing robust risk management techniques is crucial for long-term financial sustainability. Consider these advanced approaches to protect your investments:

- Utilize stop-loss orders to limit potential losses

- Implement dollar-cost averaging techniques

- Maintain an emergency fund covering 6-12 months of expenses

- Regularly monitor and rebalance investment portfolios

Passive Income Tax Considerations

Understanding tax implications is fundamental to maximizing your passive income potential. Different income streams have unique tax treatments, so consulting with a financial professional can help optimize your strategy and minimize tax liability.

Technology-Driven Investment Tools

Modern investment platforms offer sophisticated algorithms and analytical tools that can help investors make data-driven decisions. Robo-advisors and advanced tracking software provide insights that were previously available only to institutional investors.

Psychological Aspects of Investing

Emotional discipline is a critical yet often overlooked component of successful passive income generation. Investors must develop the ability to make rational decisions, avoid impulsive actions, and maintain a long-term perspective despite market fluctuations.

Ultimately, creating sustainable passive income requires a holistic approach that combines strategic planning, continuous education, and adaptable investment techniques. By understanding your financial goals and implementing a diversified, risk-aware strategy, you can develop multiple income streams that provide financial freedom and stability.

Leveraging Technology and Automation to Maximize Passive Income Potential

In today's digital age, technology has revolutionized the way people generate passive income, offering unprecedented opportunities to break free from traditional employment models. Smart entrepreneurs are now using cutting-edge tools and automation strategies to create sustainable income streams that can potentially replace full-time job earnings.

Digital Platforms for Passive Revenue Generation

Modern technology enables individuals to monetize their skills and assets with minimal ongoing effort. Online platforms have emerged as powerful vehicles for creating passive income through various innovative approaches:

- Automated content monetization platforms

- Algorithmic investment tools

- Machine learning-powered affiliate marketing systems

- Scalable digital product creation networks

Artificial Intelligence and Passive Income Strategies

Artificial intelligence has transformed passive income generation by streamlining processes and reducing manual intervention. AI-driven tools can now manage complex income-generating activities with remarkable efficiency, allowing individuals to create sophisticated revenue streams without constant personal management.

Key AI-Enhanced Income Opportunities

- Robo-advisors for intelligent investment management

- Automated dropshipping platforms

- Machine learning-powered content recommendation engines

- Predictive analytics for real estate and stock market investments

Technological Infrastructure for Passive Income

Building a robust technological infrastructure is crucial for developing sustainable passive income streams. Cloud computing, sophisticated software applications, and integrated digital ecosystems provide entrepreneurs with powerful tools to create and manage income-generating assets efficiently.

Essential Technological Components

- Cloud storage solutions

- Automated payment processing systems

- Customer relationship management platforms

- Advanced analytics and tracking tools

Diversified Digital Revenue Channels

Successful passive income strategies involve creating multiple interconnected revenue streams that leverage technological capabilities. By integrating various digital platforms and automation tools, individuals can develop a comprehensive income generation ecosystem.

Potential Digital Income Streams

- Online course creation and sales

- Affiliate marketing networks

- Digital product marketplaces

- Subscription-based content platforms

- Automated e-commerce stores

Investment in Technological Skills

Developing technological proficiency is increasingly important for individuals seeking to create passive income streams. Understanding digital tools, automation techniques, and emerging technologies can significantly enhance one's ability to generate sustainable digital revenue.

Critical Skills for Digital Income Generation

- Basic programming knowledge

- Digital marketing understanding

- Data analysis capabilities

- Platform integration techniques

The intersection of technology and passive income represents a transformative opportunity for modern entrepreneurs. By embracing automation, leveraging sophisticated digital platforms, and continuously adapting to technological advancements, individuals can create robust income streams that offer financial flexibility and independence.

Success in this domain requires strategic planning, continuous learning, and a willingness to experiment with innovative technological solutions. Those who effectively harness these digital tools can potentially develop passive income streams that not only supplement but potentially replace traditional employment income.

Conclusion

Transforming your financial landscape through passive income streams requires strategic planning, persistent effort, and continuous learning. The journey from traditional employment to financial independence is not an overnight process but a calculated pathway of diversified revenue generation.

By implementing the strategies discussed—ranging from digital investments to technological automation—you can systematically build a robust passive income portfolio. The key is not just creating multiple income channels, but strategically managing risks and scaling your efforts methodically.

Your success depends on embracing a growth mindset and understanding that passive income is an evolving ecosystem. Technology, market trends, and innovative platforms continuously present new opportunities for those willing to adapt and invest intelligently. Whether you're exploring affiliate marketing, real estate investments, digital products, or automated online businesses, consistent action and smart decision-making are crucial.

Financial freedom isn't about replacing your entire income immediately, but gradually building resilient revenue streams that provide increasing financial flexibility. Start small, reinvest your earnings, and continuously educate yourself about emerging passive income strategies.

Remember that every successful passive income journey begins with a single step. Your commitment to learning, experimenting, and optimizing your approach will determine your long-term success. Embrace calculated risks, leverage available technologies, and maintain a disciplined approach to investment and income diversification.

The path to replacing your full-time job with passive income is challenging but entirely achievable. Stay focused, remain patient, and trust in your ability to create sustainable financial independence through strategic passive income development.

Tired of Scams? My #1 Recommendation

If you have landed on this blog, you want to actually know how to make money online right - then click the big red button below and partner with me!

Digital Economy is the #1 Online Business Model for those just starting out.

.png)